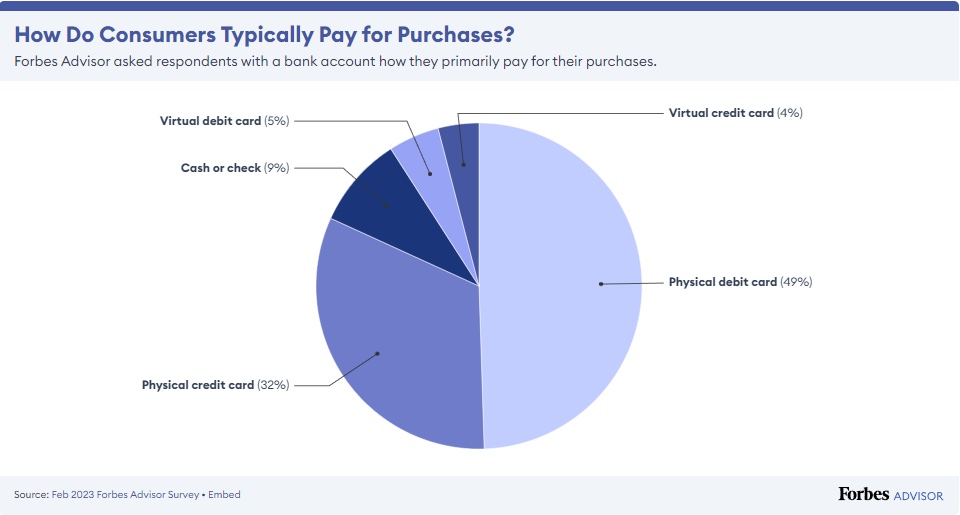

A recent survey by Forbes Advisors from February 2023 revealed that cash payments account for only 9% of purchases among Americans. Debit and credit cards are the main payment methods used, with 54% of consumers using physical or virtual debit cards and 36% using physical or virtual credit cards. This suggests that credit cards are gaining ground compared to cash or other forms of payment.

And according to CouponBirds’s research, the outstanding credit card balance in November 2022 was up nearly 17% from the previous year, debt threatens the lowest earners as they can’t keep up with necessary expenses.

Credit cards have become an essential part of our daily lives, allowing us to shop, pay bills, and book travel tickets with ease. With so many credit card options available in the market, it can be challenging to choose the one that’s right for your individual needs. In this article, we’ll examine the current state of credit card usage and explore the best credit card options for different groups of people.

For College Graduates

The best cards for recent graduates have low annual fees and offer high approval rates for young, relatively inexperienced applicants. Graduate credit cards also report account information to major credit bureaus on a monthly basis, providing graduates with an opportunity to build a credit history.

Bank of America® Unlimited Cash Rewards credit card for Students

The Bank of America ® Unlimited Cash Rewards Student credit card is the top cash-back credit card for students, with 1.5% cash back on all purchases and an annual fee of $0. After spending $1,000 in the first 90 days, you’ll receive an initial bonus of $200 and an introductory APR of 0% over 18 billing cycles.

This card can be used for everything from everyday purchases such as gas, online shopping, grocery and eating out, to those needing help with big-ticket purchases. However, it’s important to note that there’s a 3% foreign transaction fee, so it’s best to avoid using it while traveling abroad.

Discover it® Secured Credit Card

The Discover it® Secured Credit card has an annual fee of $0 and gives cardholders 1-2% cash back on purchases. In addition, it doubles the amount awarded in the first year. Discover it® Secured Credit Card also requires a minimum deposit of $200, one of the minimum deposits that can be used to secure the card. Additionally, there is no annual fee or foreign transaction fee, making it an excellent option for graduates traveling abroad.

For Entrepreneurs

Small business owners, whether they’re freelancers or have a physical storefront, can benefit from business credit cards with generous rewards programs, fee tracking, and money-saving perks.

Ink Business Preferred® Credit Card

This card offers initial rewards worth $1,250, with 3x points on shipping, internet, cable, phone, and travel purchases. Additionally, this card allows you to purchase items for your business and pay them off without interest for 12 months.

Although this card has an annual fee of $95 a year, it earns 100k reward points after spending $15,000 on purchases in the first three months after opening the account. You can redeem up to $1,000 cash back or $1,250 in travel expenses with Chase Ultimate Rewards®. Earn 3 points for every $1 spent on the first $150,000 spent on travel and selected business categories on the account anniversary. All other purchases earn 1 credit per dollar.

For Personal

Applying for credit cards on a personal level allows individuals to choose a card that suits their spending habits and financial goals.

Citi Premier Card is one of the best entry cards because of its large number of reward spending categories. Not only can you earn triple points on air travel and hotels, but you can also earn triple points at restaurants, supermarkets and gas stations — offering plenty of opportunities to earn points on your daily purchases. Best of all, your points are flexible and can be transferred to various frequent flyer programs in each airline alliance. Finally, you can save $100 a year on a single stay reservation of $500 or more (excluding taxes and fees) through Citi. But it comes with an annual fee of $95 a year and lacks the travel protections that come with other travel rewards cards.

Blue Cash Preferred® Card from American Express

The Blue Cash Preferred Card is one of the best cash back credit cards on the market. You will be rewarded in a wide range of bonus categories, a substantial welcome bonus and $0 intro annual fee for the first year, then $95.

The card entitles you to 6% cash back on purchases of up to $6,000 a year at U.S. supermarkets; 6% cash back on selected US streaming subscriptions; 3% cash back on transportation, including taxi/carpool, parking, tolls, trains, buses, etc. 3 percent cash back at U.S. gas stations and 1 percent cash back on other purchases. But the supermarket bonus category has a $6,000 spending cap, which may not apply to those with large grocery budgets. And you have to pay foreign transaction fees for international purchases, so try not to use this card when traveling abroad.

Choosing the right credit card can be difficult. Individuals should assess their needs and financial goals to select a credit card that aligns with their habits and priorities. No matter the preference, there is a credit card that can cater to anyone’s financial situation.

Advertising disclosure: We may receive compensation for some of the links in our stories. Thank you for supporting LA Weekly and our advertisers.