If you’re frustrated by the high cost and inconsistent quality of cannabis products, you’re not alone. Now legal for recreational use in 11 states and Washington D.C., cannabis products accounted for over $8 billion in revenue in 2018 alone. Nevertheless, the buying experience can be difficult and costly for consumers.

Product prices are affected by unique challenges and disadvantages that canna-businesses face. The marijuana industry is like no other industry out there, due to a number of factors:

- The disconnect between state and federal law

- The lack of FDA regulation

- The lack of legislative preparedness in states where marijuana is a new and largely untested frontier

- The inevitable safety concerns arising from a cash-only business earning billions in revenue

To better understand how these factors affect the prices consumers pay, we asked cannabis brands to describe the challenges they face in the marketplace. They provided us with some surprising insights.

Limited Banking and Payment Processing Options

Purchasing cannabis products online can be enormously frustrating, and if you’re planning to buy in person, you better bring cash. A major part of the problem is that cannabis is illegal at the federal level, creating legal uncertainty for payment processors even in states with recreational use.

The biggest source of frustration we found among cannabis businesses was the issue of banking and payment processing. Almost every business owner and representative across the board identified this issue as a persistent hurdle.

According to Shauna Blanch, co-owner of Color Up Therapeutics (a CBD skincare line), “We’ve been shut down by every processing company there is, reached out to multiple companies to build backend processing systems, and the most interesting thing lately is that we are now—after 3 years of having an online store—being considered for Square’s new pilot program for cannabis, and we are one of the first companies Bank of The West is starting to work with.”

Without a reliable banking partner, many cannabis businesses are unable to process the most basic day-to-day transactions. According to Blanch, “Banking issues affect not only our day-to-day business and overall income, but they also affect our entire sales team, our retail team, our wholesale accounts, educational classes, and our entire professional team.”

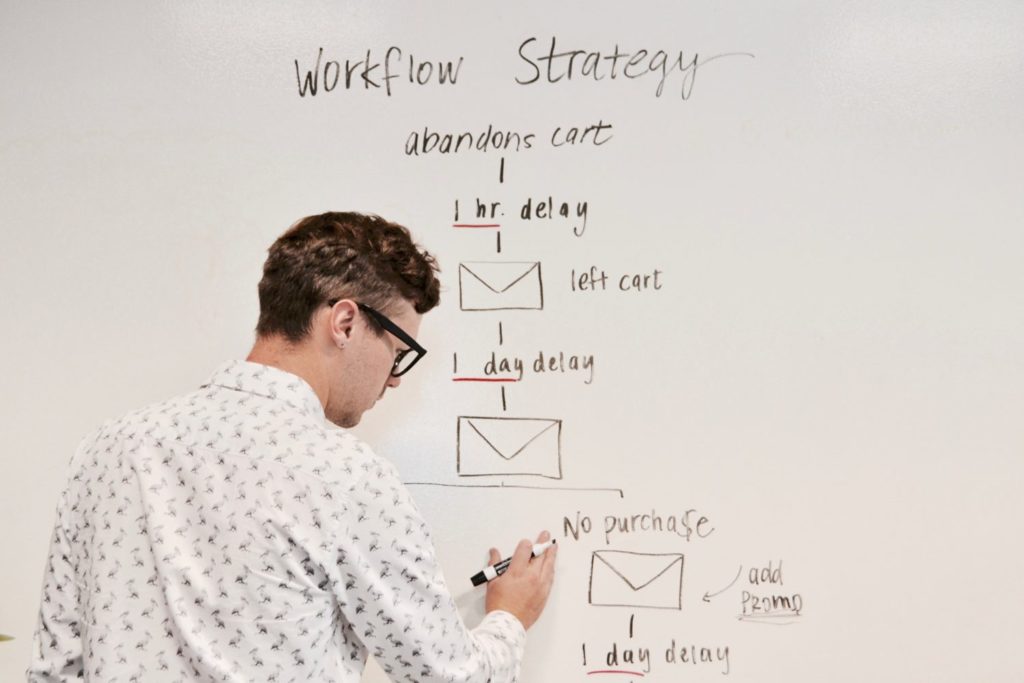

The problem extends to online shopping cart platforms, as noted by Boronia Fallshaw, founder of the cannabis company Mello. “Out-of-the-box platforms will not transact with CBD companies. We could not use Shopify, BigCommerce, or other platforms with built-in merchant processing services. So we had to carry the additional expense of building our content platform on WordPress, using WooCommerce for products and then setting up an independent MPS. This process took 6 months.”

For a bit of context, WooCommerce is a free ecommerce plug-in for WordPress, the popular website builder and content management system. Both WooCommerce and WordPress are free to use and therefore not subject to the restrictions of paid shopping cart platforms like Shopify and BigCommerce. However, WooCommerce still requires a payment system to work, and so some cannabis companies are forced to build their own merchant processing system, which can be time-consuming and costly.

For businesses that are able to find payment processing, it can come at a hefty cost. According to Dale Falkenstein at Canada Puffin Inc., “Cannabis companies are deemed high-risk, so processing rates are at a premium and there are minimum monthly payments.”

Unfortunately, this “cost of doing business” often gets passed down to the consumer. Banking fees can cost anywhere from $500 to $2,500 every month, and some banking institutions even charge a full 1% of gross revenue. For a company earning a million dollars a month, that’s $10,000 just going toward merchant fees. To make up the difference, you can expect to pay an extra dollar for every hundred dollars you spend. It doesn’t sound like much, but it’s only one small part of the picture. Your cost increases even more when you consider other factors like lab testing, regulations, and exorbitant taxes—which we’ll discuss in more detail.

High Taxes

High Taxes

When states started legalizing weed, many consumers thought that the prices would go down since we were getting a homegrown product from reputable businesses not subject to the occupational hazards of the illegal cannabis trade. We were wrong. Prices have actually gone up.

The main reason can be summed up in a single word: taxes. As states put the issue of cannabis legalization before voters, one of the main incentives found on ballot measures is the promise of tax revenue for the state. Yes, we’re legalizing cannabis, but we’re also collecting so much money for our schools! This is often great news for state and local governments, but it can make it difficult for above-board cannabis companies to compete with the black market.

Ryan Salzmann is the business development director at Saint Investment Group, which founded the largest cannabis delivery service in California. According to Salzmann, “Just like alcohol and tobacco, there is a cannabis tax rate followed by a business tax rate of goods sold. At the retail end, you have a business tax, a city cannabis tax, and a California state cannabis tax. This drives the prices way up to the customer and in turn pushes the customer to purchase unlicensed and untested cannabis products.”

So just how much are cannabis costs impacted by taxes? The best way to get an estimate is to compare the cost of legal cannabis to the cost of black-market street cannabis (which isn’t subject to taxes). Street cannabis averages $20 per gram in the U.S., and the price of legal cannabis varies from state to state depending on the taxes and regulations. In California, for example, a gram of legal cannabis averages $30.90, making it up to 54.5% costlier than street cannabis. In Nevada, a gram of legal cannabis averages $26.94, making it roughly 34.7% costlier than street cannabis. Though actual per-gram prices vary by product type (vape products cost more than cannabis flower, for instance), much of this legal vs. black-market cost disparity is due to the high taxes imposed on legal cannabis.

There is good news for consumers, though. Although black-market marijuana is cheaper than legal marijuana in the same state, states with legal recreational use have the lowest cannabis costs across the board. In other words, you can still get legal weed in California cheaper than black-market weed in Nebraska, a state that allows neither medicinal nor recreational use.

Marketing and Advertising

Before you can buy cannabis products, you have to find them. This isn’t always easy, as brands are muzzled to some extent. If you struggle to find quality cannabis products online or feel like businesses just aren’t being up front and transparent, it may interest you to know who’s actually responsible.

According to Carson Shipley, digital media coordinator at (Lux) Pot Shop, advertising laws make it difficult for cannabis businesses to reveal what they sell. “The regulations in Washington State don’t allow any sort of cannabis products or even the cannabis leaf to be publicly shown. Finding ways to stand out takes a lot of strategic planning. Working around all the ever-changing regulations while still appealing to your targeted market isn’t cheap or easy.”

Shipley notes that his business has had to get creative—at great cost—to circumvent this issue. “We’ve taken this on by hiring designers and photographers to create ads that allude to cannabis but don’t actually show it. This is expensive in comparison to a liquor store that can simply showcase the products it carries.”

Whitney Jaynes, president of the CBD company Hemp Lyfe, echoes Shipley’s sentiment. Jaynes notes that social media outlets such as Facebook and Instagram flag most cannabis-related ads. Terms like cannabis and CBD are both prohibited for the purposes of Google advertising. Jaynes notes that “we are regulated by the verbiage we use when educating and discussing cannabis. This makes it very difficult to explain what our products are and how they work and what they have done for others.”

While there are cannabis-specific online directories like WeedMaps and advertising networks like MANTIS, these options come with high monthly premiums that many up-and-coming businesses can’t afford. A WeedMaps listing starts at $295 a month and can cost more than $1,000 a month for premium placement. MANTIS has a minimum buy-in of $3,000 and costs a minimum of $500 for every subsequent deposit.

For online-based canna-businesses, organic visibility in search engines is another huge challenge. “Because PPC advertising on Google is forbidden, the competition for organic search rankings is particularly fierce,” says Igor Avidon, founder of Avidon Marketing Group, a digital marketing agency in Los Angeles that specializes in cannabis SEO. “Large canna-brands invest heavily in growing their organic search presence because it’s the only Google-direct marketing channel at their disposal. The increase in competition drives up the cost of marketing across the board.” For many brands, securing high search engine rankings is the only way to ensure online exposure among potential buyers.

So when you’re searching for cannabis products online, be patient and take some time to look past the first page of search results. The first products you see aren’t always the best products, as search engine domination in this market often has more to do with a company’s budget than their product quality.

Expensive Overhead

Expensive Overhead

As more and more consumers pursue cannabis products, one of the biggest challenges for producers is keeping up with the demand. As a result, you may have noticed that certain products can be extremely costly, and you don’t always get what you pay for.

This problem is especially apparent in the CBD market, as CBD extraction requires massive cannabis yields and can be expensive. The startup costs can exceed $1 million. As a result, some companies are cutting corners and producing low-quality or even fake CBD products.

For example, a company can cut costs by producing CBD using an inferior extraction method. CO2 extraction is the purest and highest-quality method, but it’s also the most expensive. A quality CO2 extraction machine can cost up to $450,000. Hydrocarbon extraction can be done at nearly half the cost, but it can also leave behind toxic residue and result in a grossly inferior product.

CBD companies may also save money by forgoing the independent lab testing that confirms product quality. By cutting out the lab testing, a CBD company can save over $45 a bottle on CBD, which means more profit for them but less safety assurance for the consumer. In most cases, the consumer won’t even know the problem is low-quality until they start using it and realize that it doesn’t work.

To avoid getting burned, it’s important to research cannabis and CBD products before buying. Look for companies and products that offer a certificate of analysis. The certificate should confirm the THC concentration, CBD concentration, and full cannabinoid profile, and it should also report on any contaminants.

Severe & Costly Regulations

If you’ve noticed that the marketplace seems to be dominated by just a few major brands, you’re not crazy. Smaller canna-businesses are getting absorbed by the larger competition and reducing the number of options you have as a consumer. A lot of it has to do with centralized regulation — or lack thereof.

Every state has its own set of cannabis regulations, and these requirements are constantly changing. This can create real headaches for businesses just trying to remain in compliance. Smaller businesses suffer the most because keeping the regulators happy can be a very costly endeavor.

One example is the issue of packaging requirements. According to Serge Chistov, a financial partner at Honest Marijuana Company, “This is like sticking Jell-O to the wall, virtually impossible to do every time. You think you are successful, and you finally have your product. You end up re-doing the packaging because there’s a new regulation and it now needs to be not just child-resistant but child-resistant and re-sealable. It’s very painful to do and challenging to keep up with.”

Chistov notes that the decentralized nature of cannabis sales creates challenges that smaller businesses are unable to weather. “Smaller operations are finding it harder to compete and are selling out to larger ones, especially those that have access to public financing. We are starting to see the larger cannabis stores become even larger. And slowly but surely, the medium-sized operator or wholesaler is faced with the challenges of finding a way to a store’s shelf.”

Will It Ever Get Easier for Brands?

It’s one thing to understand why the cannabis business is hard to navigate as a buyer. But knowing doesn’t make it easier. The good news is that the demand for cannabis products has inspired an entire supplementary marketplace filled with investors, payment processors, and tech organizations completely dedicated to assisting cannabis businesses and helping them to create a better experience for buyers.

Cannasure offers insurance to businesses that traditionally have a hard time finding coverage, and companies like Naturepay are making it easier for canna-businesses to process credit card payments. Green Bits is a startup that offers retailers with management and point-of-sale capabilities, and CannaFundr is making it easy for new businesses to raise capital with weed-friendly crowdfunding. There are even sites like Save On Cannabis who bring brands and consumers together by offering verified online coupons on cannabis products. The list goes on.

In addition, the government is finally starting to catch up. Just recently, the U.S. House of Representatives passed a bill protecting financial institutions that support marijuana-based business.

As the market continues to grow, you can expect better-quality products that are easier to find and available at lower prices. Though it’s a slow process, we’re already seeing it happen. And that’s something worth lighting up for.

Advertising disclosure: We may receive compensation for some of the links in our stories. Thank you for supporting LA Weekly and our advertisers.