While we are experiencing the fastest inflationary surge since 1982, and seeing the huge 50% spike in the price of gas and other goods…

The ultra-rich in Los Angeles have something more important to worry about: how to not only keep their wealth safe… but also grow their millions of dollars.

What’s their solution? Some are diversifying their portfolios with alternative assets not totally dependent on the equity market.

And there’s one potentially inflation-resistant asset they’ve been investing in recently.

George Lucas is on a spending spree, shelling out $ 1 million… $2 million… and even $15 million to acquire this asset. He now owns more than $1 billion of it.

David Geffen, one of the founders of Dreamworks, sold his home and also bought $30 million worth. He now owns more than an estimated $2.3 billion of this asset, which is around 21% of his net worth.

And actor Jack Nicholson already owns more than $150 million worth of this asset. It’s estimated to be more than 1/3rd of his net worth.

And it’s not just those three… billionaires from around the world have been following suit.

Recently, the Rothschilds sold this asset for over $197 million to the Dutch government. Oprah Winfrey sold this asset for $150 million (grossing $62 million). Jeff Bezos recently sold Amazon stock and bought $70 million worth of this asset.

The asset I am talking about is blue-chip art. And these might be reasons billionaires are investing in it:

- Blue-chip art prices outpaced the S&P 500 by 174% (1995-2020).

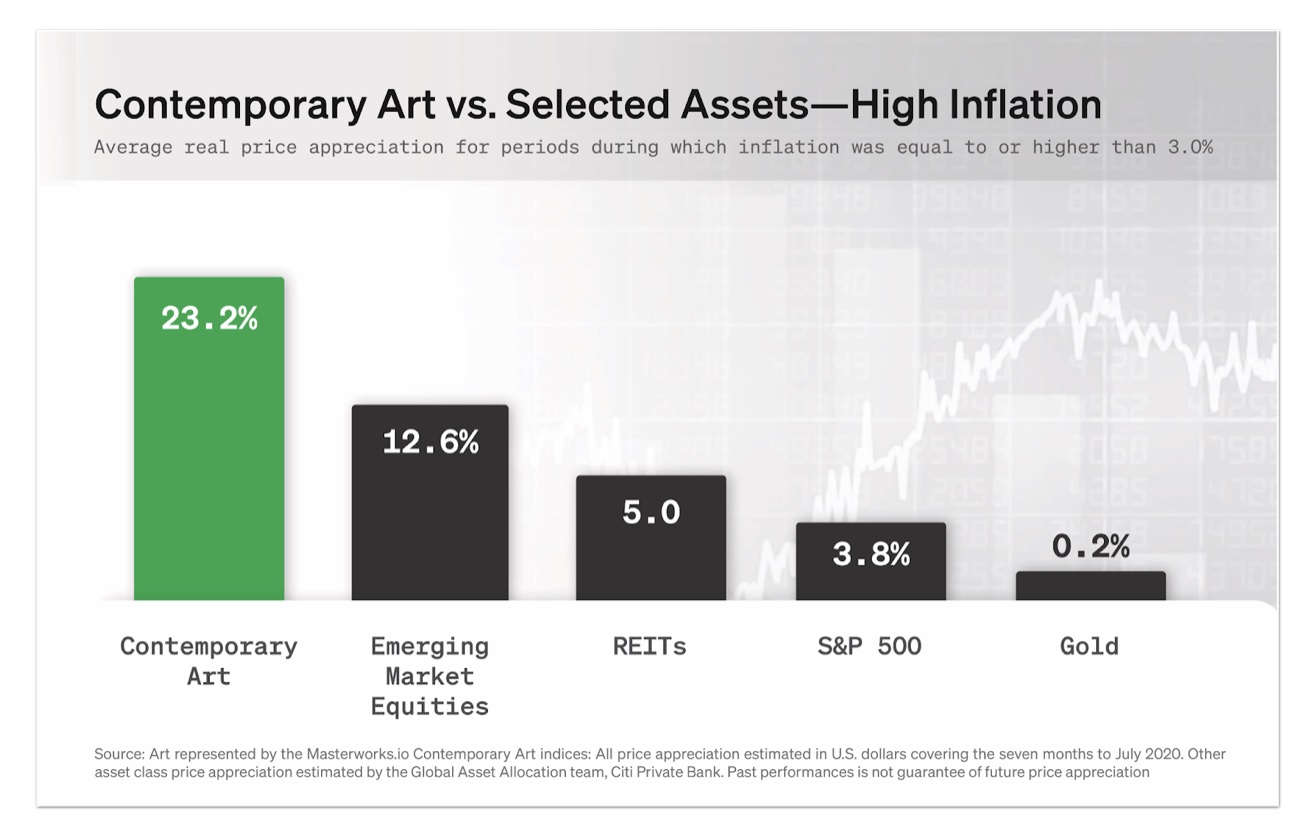

- Blue-chip art prices have appreciated 23.2% on average when inflation is at least 3%.

- Low correlation to public equities over the past two decades, according to Citi.

- Part of an estimated $1.7 trillion asset class that’s expected to grow 58% in just 5 years, according to Deloitte.

- The WSJ recently called art “among the hottest markets on earth.”

With these stats, it makes sense why up to 61% of the ultra-wealthy are investing in art right now (especially blue-chip art).

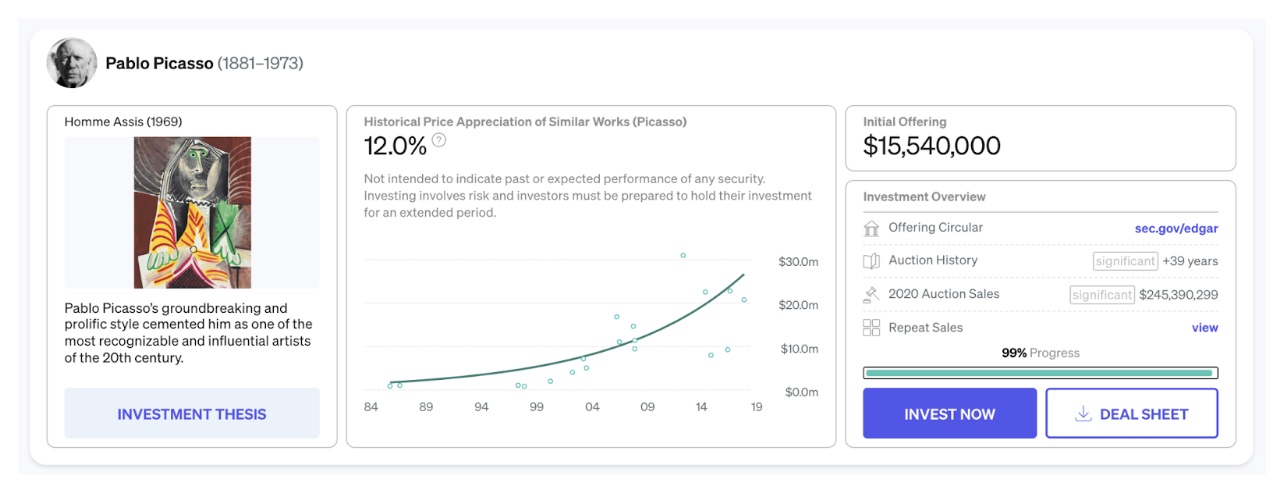

Unfortunately, most people think you have to be ultra-rich to afford to invest in an expensive painting by famous artists such as Picasso, Basquiat, and Condo. But members using the Masterworks.io art investment platform don’t need to pay the huge $1,760,000 price tag to invest in one of these alternative assets.

What is the $1 Billion Masterworks.io Platform?

Masterworks.io is an $1 billion art investment startup by Harvard, Stanford, and Columbia alumni that allows everyday investors to invest in blue-chip (contemporary) art for a fraction of the cost of buying an entire artwork.

That’s because, in 2012, the JOBS Act allowed famous artworks to be purchased by investors as individual shares representing an investment in artworks, among other alternative assets.

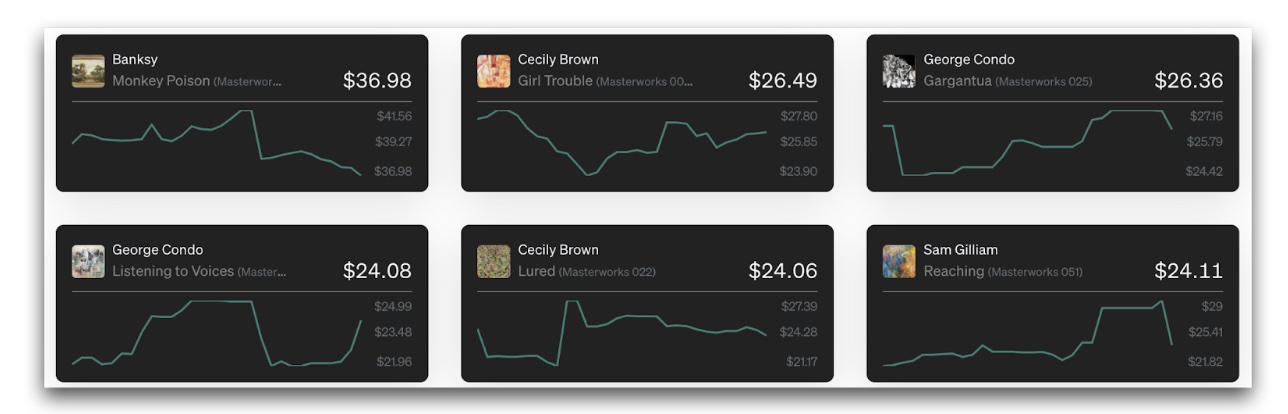

So Masterworks.io gives investors the opportunity to invest in art from famous artists, such as Banksy, Basquiat, and Warhol, piece by piece, for as little as $20…

And the platform allows everyday investors access to the same types of paintings collected by wealthy collectors like Jeff Bezos, Bill Gates, and Eric Schmidt.

With 312,234 users and counting, the Masterworks.io platform has become popular. It’s a way to invest in famous artworks without spending millions of dollars outright.

Why This Alternative Asset In Recent Times?

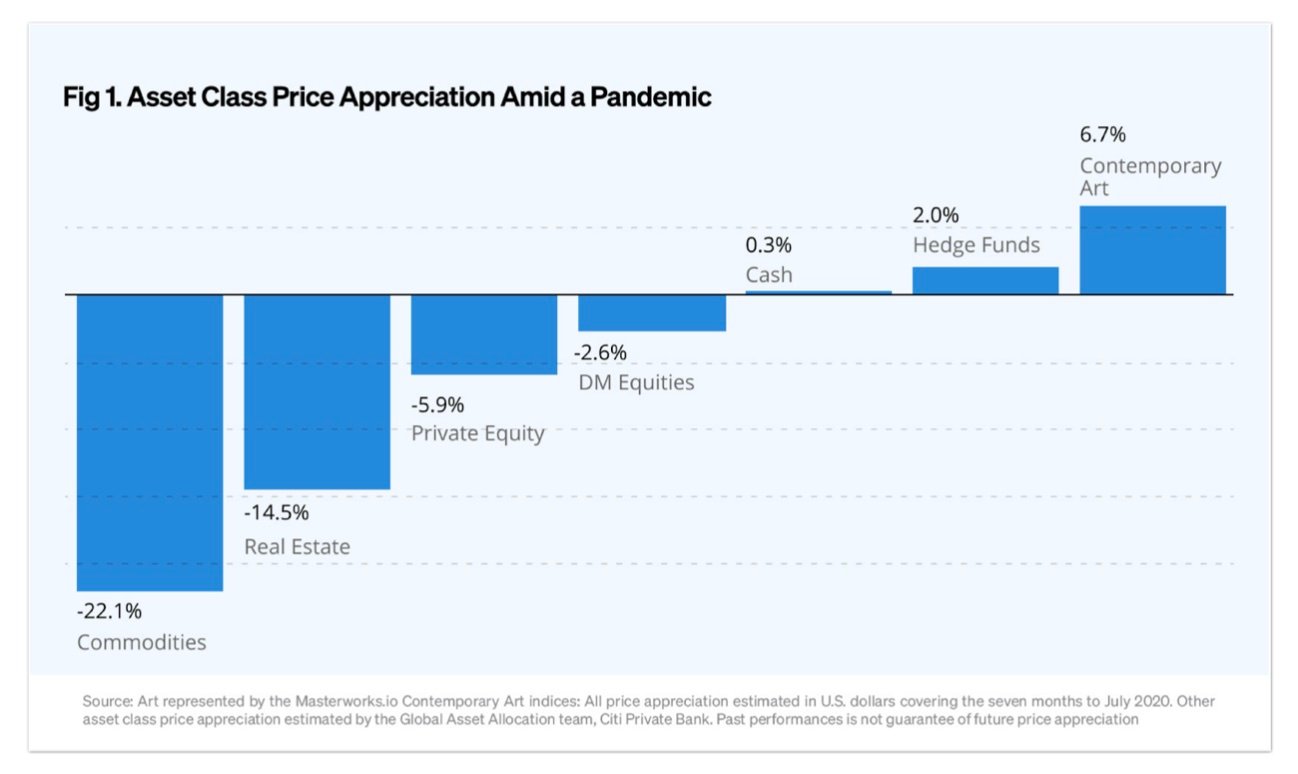

According to Citi, in the first 7 months of 2020, art has outpaced certain other asset classes such as equities, cash, real estate, commodities, and even private equity during the pandemic.

That’s because art generally has a low average correlation to the stock market, BBC explained, so blue-chip (contemporary) art prices don’t necessarily follow the direction of equity market moves.

And during periods of high inflation of 3.0% or higher, blue-chip (contemporary) art has outpaced other asset classes such as REITs, equities in the S&P 500, and gold.

So for investors who wish to diversify into an inflation-resistant alternative asset, there’s Masterworks.io.

Investors can choose to invest in artworks from artists like Pablo Picasso, Zao Wou-Ki, and Gerhard Richter on the platform.

However, once certain goals are reached for each artwork, investors won’t have a chance to invest anymore. Recently, a Banksy painting called “Exit Through the Gift Shop” sold out in less than three hours on the Masterworks.io platform.

How Does Masterworks.io Platform Work?

In 2017, CEO Scott Lynn aimed to democratize the art market by securitizing the first painting, Andy Warhol’s ‘1 Colored Marilyn (Reversal Series).

He said “That light bulb kind of turned on four years ago, and it just occurred to me that this is probably the largest asset class that’s never been securitized.”

With a track record of 20 years of building successful companies, Scott Lynn created Masterworks. It’s currently the biggest company providing direct access to multimillion-dollar works of art by artists like Picasso, Monet, and Basquiat.

This is how it works:

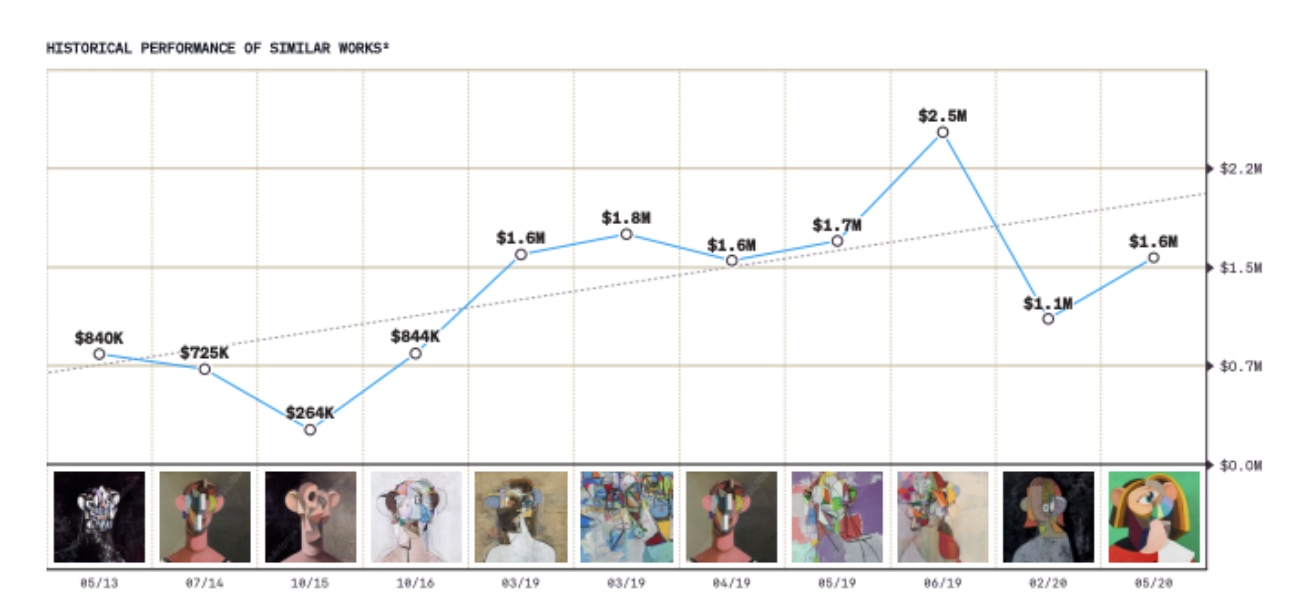

- The Masterworks.io research team analyzes over 60,000 data points across 70+ years to discover which types of work have the potential to exhibit price appreciation.

- Masterworks.io purchases and securitizes the artwork, and then makes it available to investors on the Masterworks.io platform.

- You can list your investments in the artworks to other users on the platform.

- You can also hold onto your investments in the artwork and participate in the distribution when Masterworks sells it.

Price Appreciation From Famous Artworks

Masterworks.io enables investors to receive price appreciation from paintings by famous artists such as Picasso, Monet, and Banksy listed on the platform.

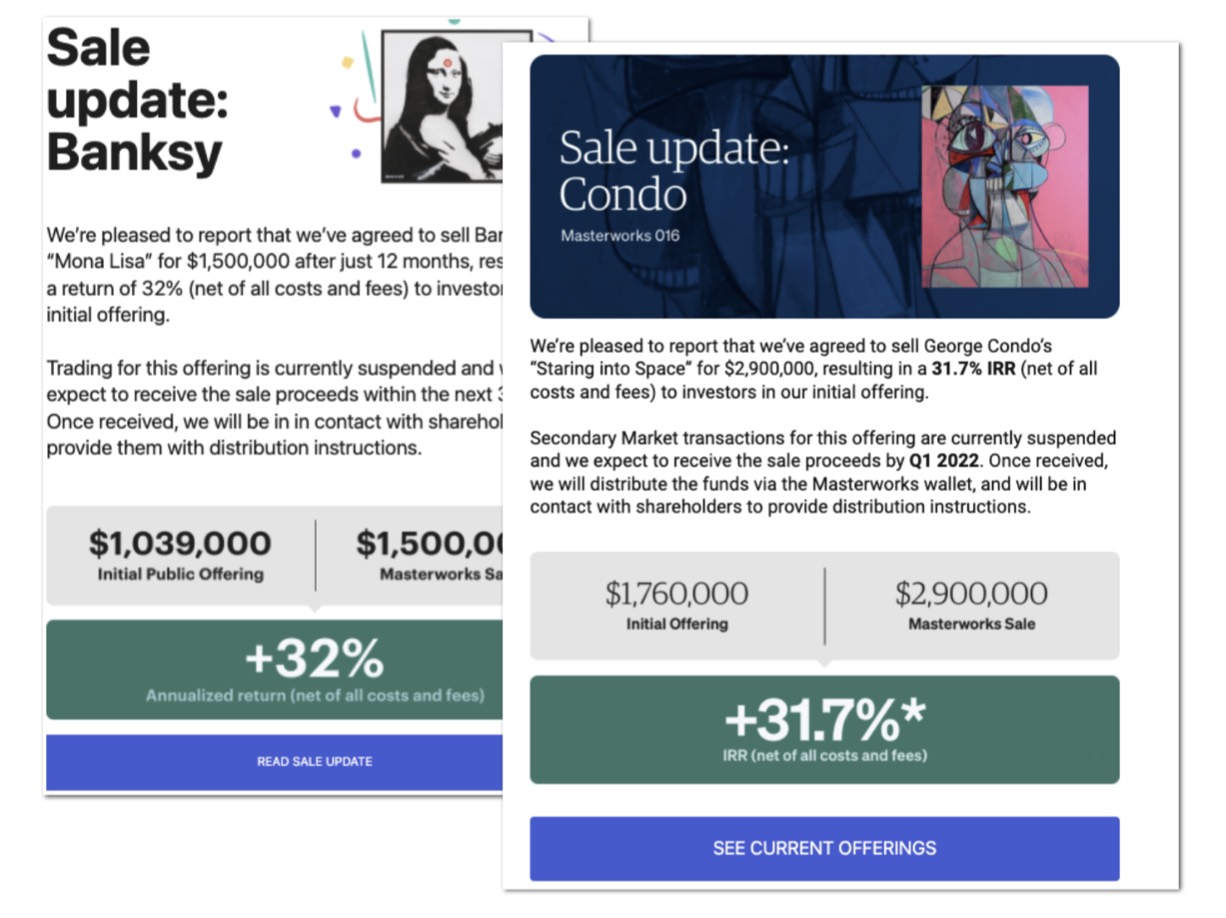

In 2020, Masterworks’ investors saw a 32% annualized appreciation, from the sale of their Banksy painting “Mona Lisa”, net of fees.

And in 2021, investors are set to receive a 31% annualized appreciation from the sale of their George Condo painting “Staring Into Space”, net of fees.

That’s why Kevin O’Leary from Shark Tank tweeted: “ANYBODY can invest in art by names like Banksy, and I love what they’re (Masterworks) doing.”

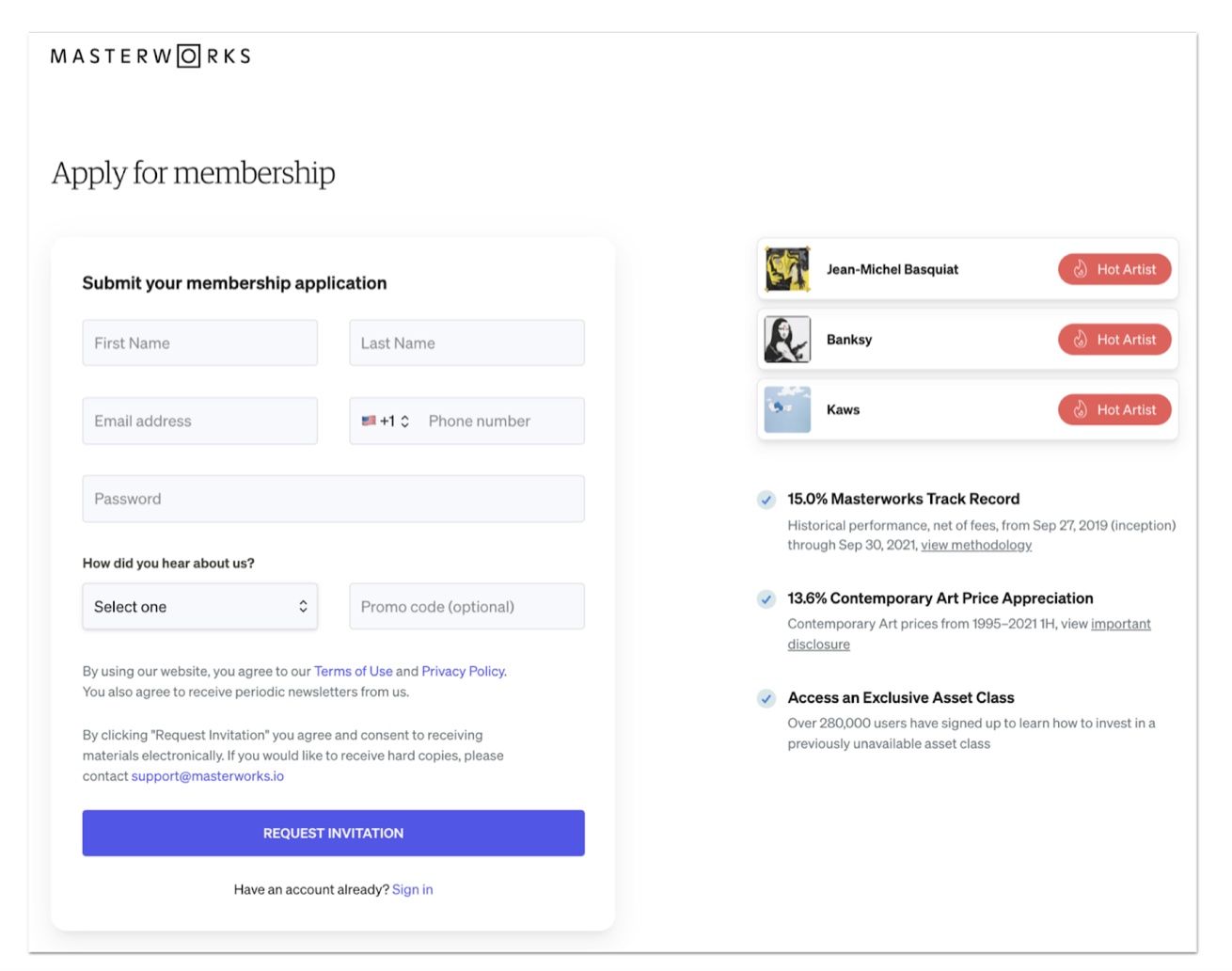

How to buy the “billionaire asset” with just a few clicks?

You only need to follow three steps to get started:

1) Go to the Masterworks’ signup page.

2) Enter your contact information and answer some questions.

3) An art investment representative will contact you and help you.

Or call 203-518-5172 (9 am – 6 pm EST Monday through Friday) to learn more about the asset class, go over your financial goals, risk tolerance, and other considerations with an art investment representative.

See important disclosures at masterworks.io/disclaimer

Advertising disclosure: We may receive compensation for some of the links in our stories. Thank you for supporting LA Weekly and our advertisers.