Whether for business or pleasure, traveling is a big part of the average American’s life. One of the downsides to taking a personal or business trip is the costs incurred, and the reality is you’re guilty of not saving money.

According to the Bureau of Labor Statistics 2019 Consumer Expenditure Survey, the average household in the United States spent around $4,580 on vacation/travel expenses, including transportation, lodging, food, and leisure. About $2,500 was spent on transportation, approximately $1,500 on lodging, and $650 on food. The remaining $430 was spent on entertainment

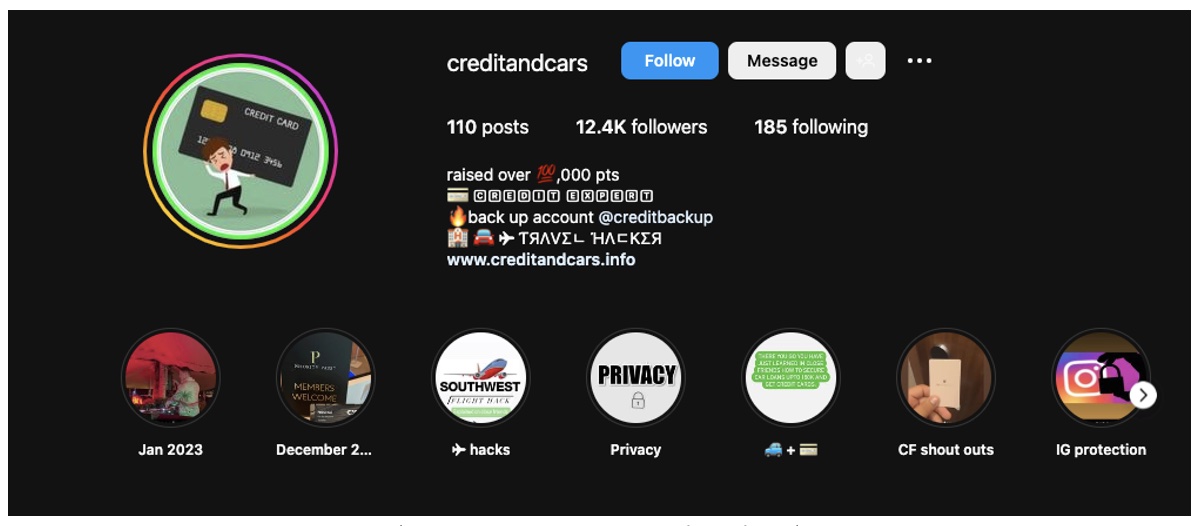

Oddly enough the average salary for people over 25 is a measly $35,295. So the average American is left with a lousy $2,400 after living expenses and massive credit card debt. As you know, compounding interest is a life sentence for credit card bills. It’s hard to save money, so you’re only left with learning travel and credit card hacking. These are just a few lessons that Shawn Younai teaches, who goes by the handle @creditandcars, teaches on his Instagram. Saving his students over 70% on their vacations.

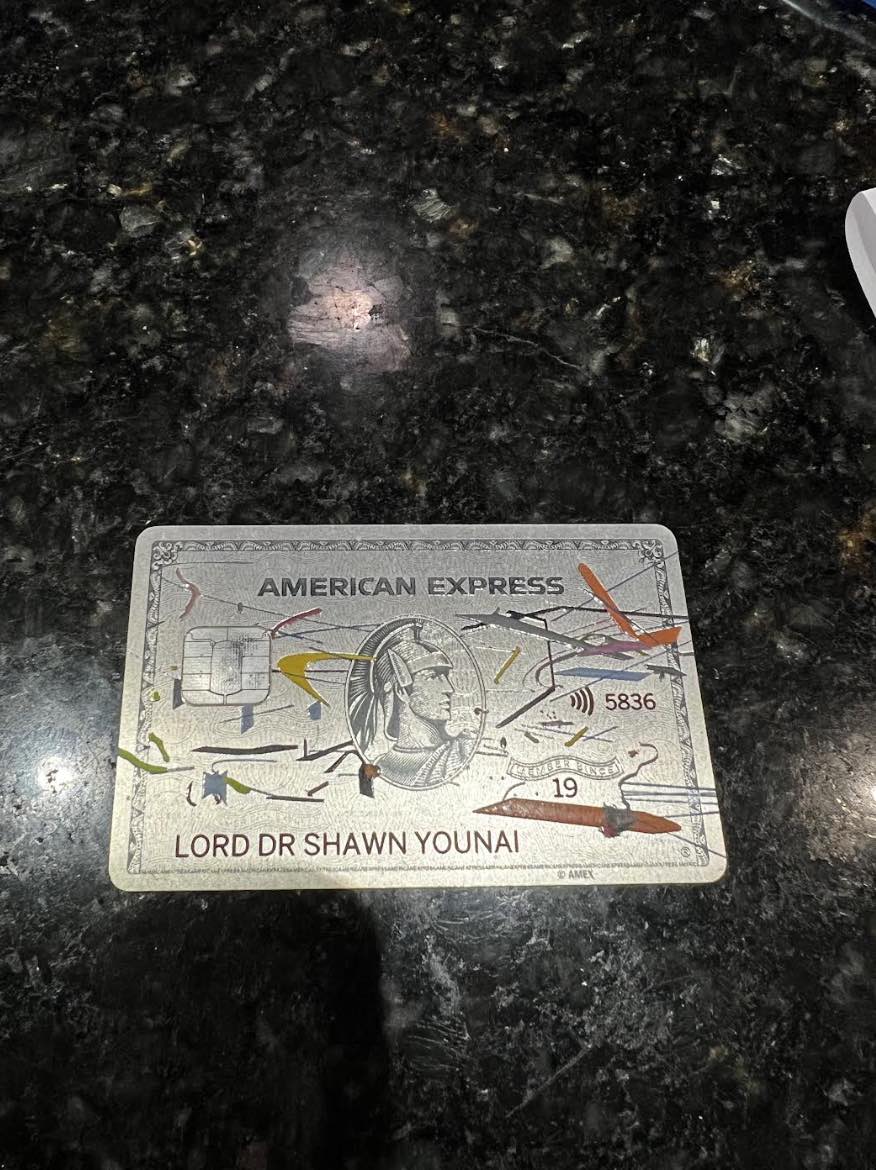

(Source: Instagram: @creditandcars)

(Source: Instagram: @creditandcars)

Shawn Younai teaches an exciting way to save money on your travels. It involves researching and taking advantage of different programs and promotions to get the best deals. It can be gratifying to find a method that allows them nearly travel for free, and the feeling of accomplishment is even more incredible when you realize how much money they saved. The secretes Shawn shares sound too good to be true, but they are legal and acceptable to use. It’s a way to have the vacations of your dreams travel while saving tons of money and getting the most out of your budget.

It’s called “Travel Hacking,” and Credit and Cars CEO Shawn Younai is considered a master at it.

“A travel hacker is a person who uses creative strategies and techniques to obtain discounted or free travel experiences.” Says Younai. But how exactly does it work?

Shawn Younai And Gary Vee

The Credit and Cars CEO, tells us that “Travel hacking involves using credit card rewards programs, finding discounted flights and hotel rooms through online deals and promotions, or using loyalty points to upgrade travel accommodations.”

It sounds easy, right? Surprisingly, most Americans have yet to learn about the secret deals and serendipitous opportunities available to them. While some Americans may feel that opening up a new credit card is a bad thing, some of the hidden benefits can surprisingly cut the cost of expenses by using points earned from using the card.

One such example is The Capital One® VentureOne® Rewards Credit Card, which offers a sign-up bonus of 20,000 points after spending $500 in the first three months. These points can then be used for travel expenses, such as flights and hotels, for 1 cent each, meaning the bonus is worth $200 (source).

This process is credit card churning this is how to get the maximum rewards from credit cards without dealing with the downside of paying annual fees. Before you engage in this process, you must be responsible, there is no point in paying an obnoxious annual fee if you’re going to also pay enormous interest charges.

So back to Credit card churning, This process is opening up a card to get the points, then downgrading or closing before the next annual fee kicks in.

Credit card churning can earn you rewards points or cash back, but it can also negatively impact your credit score.

Every time you open a new credit card, it can result in a hard inquiry on your credit report, temporarily lowering your score. Additionally, having many credit card accounts can be seen as a risk factor by lenders, which could also impact your credit score.

It’s essential to be careful if you decide to try credit card churning and to make sure that you fully understand the potential risks and downsides. It’s always a good idea to do your research and to be sure that you are making informed decisions about your financial management.

There are various different credit card bonuses that @creditandcars teaches in his mentorship program. Shawn does not advise anyone to close any credit cards but instead to downgrade the cards to the free ones offered.

The best example would be the American Express Delta Platinum card, you may think this is a fantastic card with the 80,000 points sign-up bonus, but it’s simply not. The Amex Delta platinum offers you 3X on points, while the American Express platinum offers you 5X on flights.

Younai advises opening this card, getting the signup bonus then downgrading to an American Express Delta SkyMiles card with no annual fee.

So, in essence, you will be gaining 80,000 points for $250, then downgrading to the Amex Blue and not hurting the average of your credit lines.

One factor that can affect your credit score is the average age of your credit accounts. The longer you have had credit accounts open and in good standing, the more favorably it may be viewed by lenders and credit scoring models. This is because a longer credit history can demonstrate a track record of responsible credit management.

If you have a low average age of credit accounts, it could be seen as a risk factor by lenders and credit scoring models. This is because a shorter credit history may make it more difficult for lenders to assess your creditworthiness and ability to repay a loan.

That being said, it’s important to note that the average age of your credit accounts is just one factor that can impact your credit score. Many other factors can also affect your credit, including your payment history, the amount of debt you have, and the types of credit you have used.

“Travel hacking is a combination of lucrative offers and making your credit work for you,” Says Younai.

For example, people can quickly find themselves racking up a few hundred thousand points just by using these unique credit cards to pay for their typical living expenses instead of debit.

The way Shawn breaks it down is like this: “Imagine using one of these point-based credit cards for the whole year to pay for your bills and then paying the credit card balance off with your debit. What happens is that you spend the same amount you would be spending anyways, except you’re earning points, that by the end of the year could add up to $5,000+ in travel expense credits.”

In fact, most airlines and hotels offer loyalty rewards programs and credit card offers which can sometimes be stacked with each other to provide additional bonuses that cut the costs down to next to nothing.

There are various ways of saving money and traveling for free, it just depends on the perspective of how you see things. He has spent hours researching and building strategies to help elevate your understanding of travel hacking.

According to the Credit and Cars travel hacking mastermind, research and deal hunting are also a part of the travel-for-less art.

Here are 10 tips the expert says can help anyone travel-hack their way around the world for pennies on the dollar:

- Sign up for travel reward credit cards with generous sign-up bonuses.

- Take advantage of rewards programs that give you points for everyday purchases.

- Book flights during off-peak hours and times.

- Book flights using points, miles, or a combination.

- Take advantage of promotional offers from airlines and hotels.

- Use public transportation or ride-sharing services like Uber and Lyft to save on transportation costs.

- Look for discounted hotel rooms and vacation packages.

- Join loyalty programs and earn points for future travel.

- Use airline and hotel rewards for upgrades or discounts.

- Look for travel rewards credit cards with no annual fee.

While all of the tips mentioned can easily be used by most people, many don’t know about the secrets of saving by spending, or as Shawn Younai calls it: Travel Hacking.

If you want to learn more about how to save by spending or spend less when traveling, be sure to check out @creditandcars on Instagram, where Shawn shares daily travel hacking and all credit fixing tips. You can also visit their website here

(source: https://www.bls.gov/cex/csxann19.pdf).

Advertising disclosure: We may receive compensation for some of the links in our stories. Thank you for supporting LA Weekly and our advertisers.