It’s an unfortunate fact that people fall prey to scams every day. A Truecaller report showed that, in 2021, Americans lost nearly $30 billion to phone scams well before the year’s end, proving there was a pandemic of scam calls while the country was dealing with the COVID-19 pandemic. Thirty-one percent of Americans said they fell prey to phone scams, with 19% doing it more than once.

Scam calls aren’t the only type of fraud or dishonest business practice that people should be wary of, though. Someone with bad intentions can target any person to be a part of their scheme, be that as the victim, an unwitting helper, or a potential scapegoat. Even in cases where there’s no premeditation, the way events unfold might easily leave someone shouldering an undue volume of blame. Gurvin Singh’s story could fit any one of these descriptions.

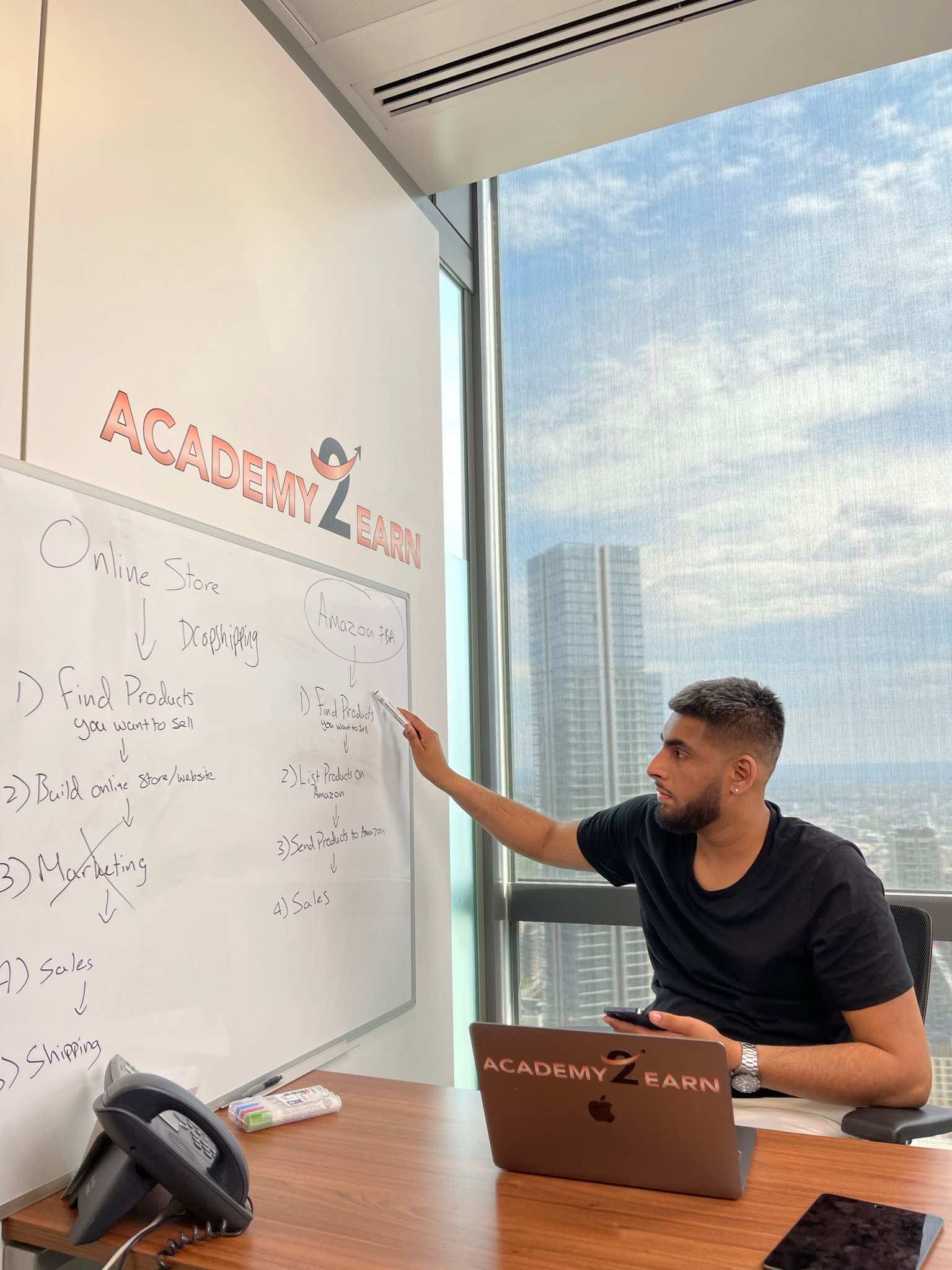

According to an Instagram post in which he clarified his involvement in an investment program that lost people millions of pounds, the reason why Gurvin Singh has become part of the program was his ability to reach substantial audiences online. The founder of Academy2Earn was an affiliate marketer at the time, and a prominent one at that—or at least prominent enough to attract the attention of two people who at the time he believed worked for INFINOX. It would later turn out that only one of them did; the other was an influencer just like Gurvin was.

Seeing his role as an introductory one, where he’d introduce the company to a new audience and potential client pool, Gurvin Singh proceeded to sign a contract with a company other than INFINOX. At the time, he claims to have had no reason to believe anything would go wrong, as he had been in INFINOX’s central London offices, and everything looked legitimate enough to him.

In this particular case, working with third-party companies could have presented a risk for Gurvin Singh and the people he introduced to the investment scheme. The financial industry is fairly heavily regulated in Gurvin’s native UK, much more than in some parts of the world. Taking people’s money and investing it offshore in a jurisdiction that has fewer protections in place is a sure way to avoid local regulators and engage in riskier dealings on the stock market. The authorities are yet to conclude whether this is what indeed happened.

What Gurvin Singh claims, however, is that it wasn’t him who had access to the investors’ money, or who made the trades in their name. He can also attest that he was left as the face of the project even though, per his post, the company he signed the agreement with stopped paying him well before the investment scheme crashed and people lost all their money. His experience sure is a cautionary tale for anyone who receives an offer to promote anything to their audiences online.

Advertising disclosure: We may receive compensation for some of the links in our stories. Thank you for supporting LA Weekly and our advertisers.