In partnership with The Fresh Toast

Gen Z and Millennial cannabis consumers currently make up 38% of the marketplace in fully legal states, but they are often tough-to-reach by traditional means.

Many brands often struggle with figuring out what young people like. Fortunately for cannabis companies, a new report out of strategic advisory studio Headquarters (HQ) has some answers.

According to the HQ Cannabis Brand Affinity Report, hip-hop, R&B, fashion, social media influencers and gaming are among the top interests young lifestyle cannabis consumers share.

The study was issued in collaboration with The Statement Group (SG), a quantitative and qualitative brand strategy consulting firm. It breaks down the top passions and common values shared by Gen Z and Millennial cannabis consumers in 2020.

Why It Matters

“The Gen Z and Millennial cannabis consumer segment is rapidly growing and currently makes up 38% of the marketplace in fully legal states, but they are often tough-to-reach by traditional means,” Headquarters CEO Daniel Abrahami told Benzinga. “Our goal is to give brands a competitive advantage by providing specialized data. In today’s marketplace, these insights are a key for cannabis entrepreneurs to build authentic and community-driven initiatives.”

According to Business Insider, the Gen Z’s spending power stood at $143 billion in January of 2020; Millennials, for their part, spend roughly $600 billion a year.

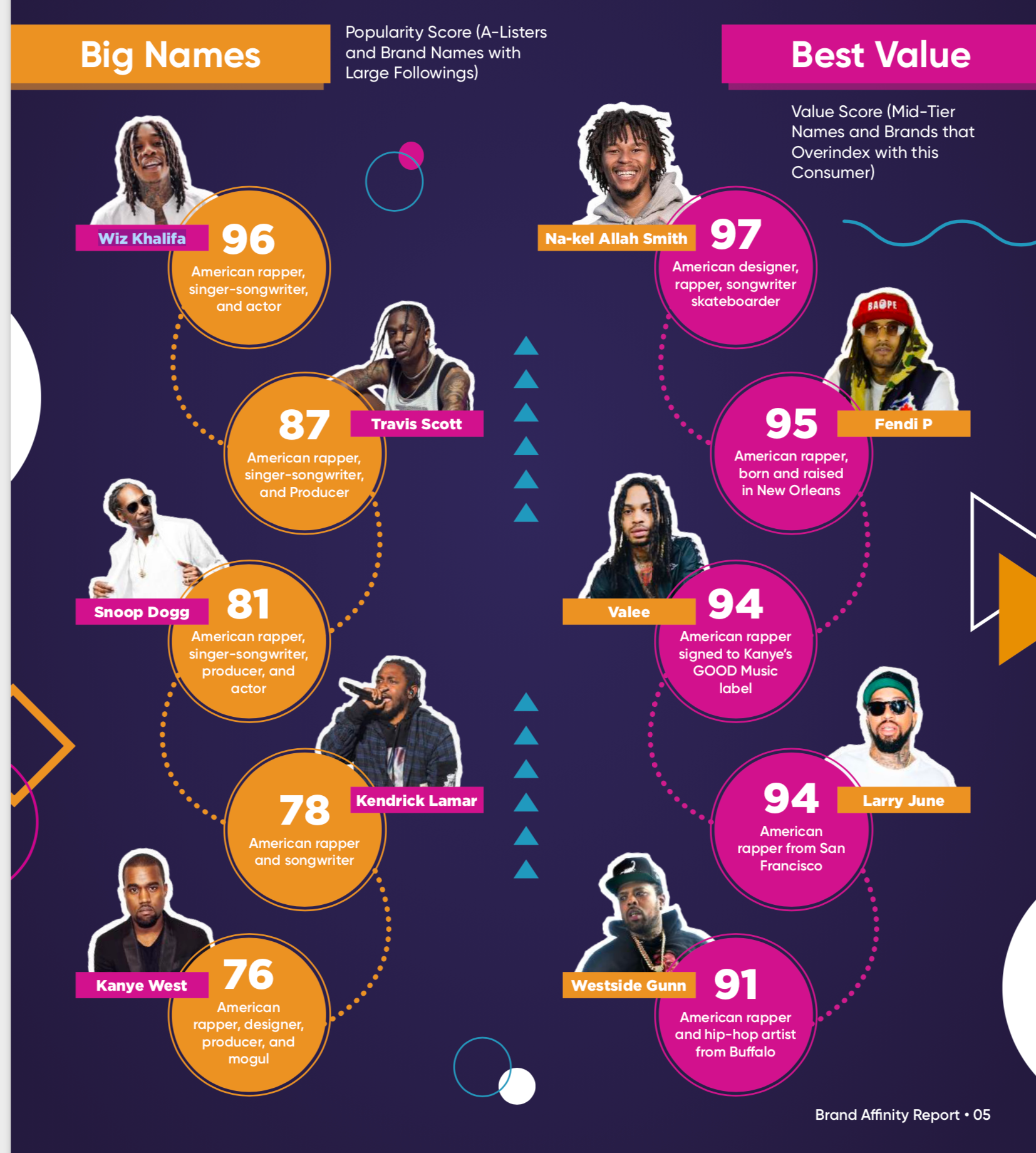

As ranked by the relevance these consumers give to certain artists — on a 1 to 100 scale — the following were the scores for the top performers:

Other noteworthy names that got high scores included EDM producers Marshmello (63) and Alison Wonderland (79); gamer Nijna (67); entrepreneur Jordan Daley (76); lifestyle brand Supreme (89); fashion brand Just Don (94); and influencers Stoney Sunday (77), Ngaio Bealum (76), and Dope as Yola (74).

How The Data Was Collected

HQ collects data using proprietary software, which analyzes millions of social media and online connections across 56 online categories such as music, podcasts, apparel, athletes, politics, automotive, food, wellness, celebrities, online influencers, TV personalities, entertainment, technologies and gaming.

RELATED: Millennials Are Fueling The Cannabis Economy

The report’s “Value Score” identifies which medium and micro-sized brands, publishers, celebrities, influencers, and more, that over-index with specific consumers.

HQ also pinpoints the names that resonate with a targeted consumer group, and uncovers the ones that are “actionable” for most budgets, Abrahami says.

RELATED: Here’s How Millennials And Boomers Differ On Marijuana Use

“By partnering with The Statement Group, we can curate a detailed roadmap for brands to create revenue-driving partnerships, paid media campaigns and social media and native content strategies. This results in enhanced engagement and the development of stronger loyalty and emotional connection with consumers,” he added.

This article originally appeared on Benzinga and has been reposted with permission.

Read more on The Fresh Toast

Advertising disclosure: We may receive compensation for some of the links in our stories. Thank you for supporting LA Weekly and our advertisers.