Bitcoin is now regarded as a form of digital gold. The rising value of the premier digital asset has prompted investors to search for the best Bitcoin exchanges to manage their investment portfolios.

This guide highlights what Bitcoin exchanges are, the factors to consider when choosing an exchange and the top Bitcoin exchanges USA.

Best Bitcoin Exchanges List

Investors are consistently looking for the best exchanges to buy Bitcoin to help facilitate their investments and monitor their portfolios. Several exchanges can offer such services, but we recommended these five platforms as the best Bitcoin exchanges to use.

- eToro – Overall Best Bitcoin Exchange

- Webull – Cheapest Bitcoin Exchange

- Binance – Best Crypto Exchange for Asset Diversity

- Coinbase – Top Crypto Exchanges for Beginners

- CEX – Most Secure Bitcoin Exchange for PRO Traders

- Crypto.com – Top exchange with the best campaign

- Blockfi – All in one trading, lending and interest on your assets

The Best Bitcoin Exchanges Reviewed

1. eToro – Overall Best Bitcoin Exchange

eToro is considered one of the best cryptocurrency exchanges available on the market for various reasons. The platform ticks the checklist of the most important things to consider when choosing an exchange platform. The social trading platform has one of the lowest fee rates for trades and is highly secure due to the regulatory bodies that oversee its activities.

eToro is also considered one of the best crypto exchanges worldwide for its multitude of operational licenses globally. The broker is licensed by the major financial watchdogs in Australia, Cyprus, the US and the UK’s Financial Conduct Authority (FCA), which shows the platform is a trusted and reputable broker to work with. As such, if you’re wondering how to buy Bitcoin UK, eToro has you covered.

The eToro platform is one of the best exchanges for Bitcoin, as deposits and maintenance are free of charge on the platform. Trading fees are processed as spreads and are usually within 0.75% to 5% depending on the crypto asset. The minimum deposit for US investors is $10 on eToro. Withdrawals are charged at $5.

The platform is suitable for new traders, enabling them to make successful trades using eToro’s CopyTrade technology. The CopyTrade technology allows novice traders to copy the trade of more experienced traders, which helps them profit despite their lack of knowledge of crypto trading concepts.

To make deposits on eToro, bank transfers, wire transfers, Skrill, PayPal, credit/debit cards are the supported payment methods to use.

Pros:

- Low trading fees

- Highly secure and regulated

- Several payment methods available

Cons:

- $5 withdrawal fee

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

2. Webull – Cheapest Bitcoin Exchange

Webull is one of the top crypto exchanges today and is regarded as the cheapest Bitcoin exchange available for US investors. The platform does not charge traders commissions or fees on trades. However, users are expected to pay for spreads that vary depending on the cryptocurrency.

Unlike most platforms, Webull doesn’t have a minimum deposit. This opens up the platform to users from all income brackets.

The exchange is regulated by the Securities and Exchange Commission (SEC) and is a member of the Securities Investor Protection Corporation (SIPC) and the Financial Industry Regulatory Authority (FINRA). The platform offers users access to over 50 cryptocurrencies to trade from.

Like most Bitcoin exchanges, Webull offers Automated Clearing House (ACH) transfers, electronic transfers and wire transfers as valid payment methods.

Pros:

- User-friendly platform

- Low transaction fees

- Easy-to-use platform.

Cons:

- No credit card deposits

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

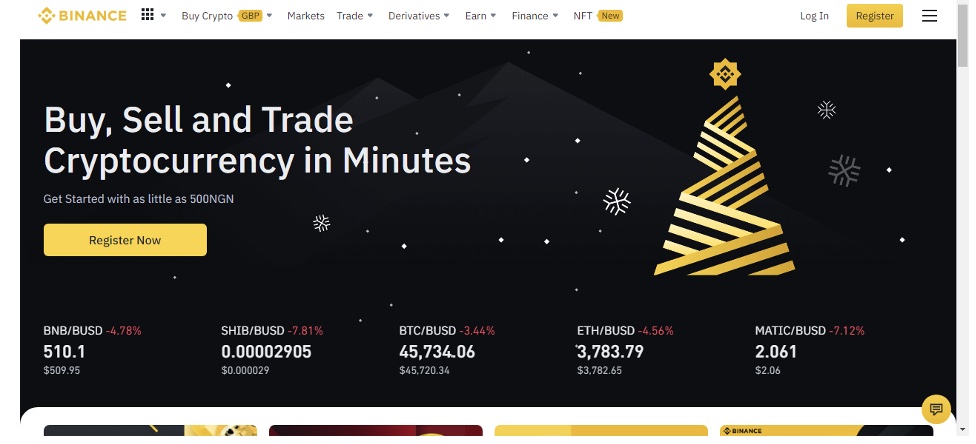

3. Binance – Best Crypto Exchange for Asset Diversity

Binance is regarded as one of the top Bitcoin exchanges for asset diversity because the platform offers users access to over 500 cryptocurrencies and various investment services and options.

Binance is considered the largest crypto exchange by trading volume. The platform has affordable fees for users. Deposits and conversions are free, while minimum deposits are set at $10. Withdrawal fees are generated based on the crypto asset and the size of the asset. The platform offers no commissions on trades and has a base fee of 0.10%.

The exchange offers debit/credit cards, SWIFT, SEPA and bank transfers as payment methods.

Pros:

- Large crypto-asset offerings

- Low minimum deposit

- Low trading fees

Cons:

- Not regulated

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

4. Coinbase – Top Crypto Exchange for Beginners

Coinbase is an online platform that facilitates the buying, selling and holding of crypto assets. The company ranks as one of the top crypto exchanges available in the market today. The platform is renowned for having a user-friendly interface that caters to the needs of new traders.

Undoubtedly, Coinbase is one of the best crypto exchanges for beginners. The exchange has a bank of learning materials and programs that enable crypto novices to understand basic concepts and leverage them to make profits.

Coinbase supports over 100 cryptocurrencies for users to buy, sell, and trade. Coinbase’s E-Money Services are regulated by the Financial Conduct Authority (FCA) to protect user information and assets.

The platform charges a deposit fee of 3.99% on debit card deposits. Other charges are derived based on the trade size, with transactions under $10,000 attracting a taker and a maker fee of 0.50%. The platform supports Apple Pay. Google Pay, PayPal, wire transfer, ACH transfers and debit cards as valid payment methods.

Pros:

- User-friendly interface

- Wide range of crypto assets

- High liquidity and buying limit

Cons:

- High transaction fees

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

5. EX – Most Secure Bitcoin Exchange

Are you searching for the safest crypto exchanges to buy your Bitcoin? Look no further than CEX.

CEX is registered as a Money Services Business and is regulated by the Financial Crimes Enforcement Network (FinCEN). The exchange has a Distributed Ledger Technology (DLT) license, issued by Gibraltar Financial Services Commission (GFSC), with Money Transmitter Licenses (MLTs) in 33 US states.

The platform supports Visa/Mastercard credit/debit cards, SWIFT, ACH, SEPA, EPay, Skrill, Faster Payments and Domestic wire transfers. Users can make no less than $3,000 deposits and $10,000 withdrawals, depending on the verification level. For deposits, commissions are charged at 2.99% for Visa/ Mastercard options. Skrill requires up to 3.99% for deposits, and 1% for withdrawals and other payment methods are free on all 111 crypto assets available on the platform.

Pros:

- User-friendly interface

- Very secure and regulated

- Good range of crypto assets

Cons:

- High deposit fees

6. Crypto.com

Crypto.com has surely made a hit and made everyone turn their heads because of its marketing strategy. Firstly, Crypto.com recently signed a sponsorship deal with the biggest mixed martial arts company in the world – UFC. This cost them around $175 million dollars, to have their logo shown by training staff, fighters kit items and other places. Other than that, Crypto.com bought the naming rights to the previously known Staples Center in a $700 million deal.

These are all to show that the company is here to stay and it is pushing its name to let everyone know that they mean business. Crypto.com offers trading on all the major cryptocurrencies, while also utilizing over 20 fiat currencies. The company also allows users to own their own crypto debit card. The debit card will allow customers to be able to use crypto to buy stuff where Visa is accepted.

Pros:

- Their own debit-card

- Secure, regulated and widely known

- Wide range of crypto assets

Cons:

- Some services not offered in the U.S

7. Blockfi

Blockfi is a platform that offers various different crypto-related services all under one roof. The platform creates a lot of convenience for its customers, mainly helping its users not to mishandle their assets by moving them through various services. Having everything under one roof helps the user choose what they do with crypto very quickly and very easily.

Blockfi is an all in one solution offering, trading on crypto assets, interest accumulation and lending. With Blockfi you can loan your crypto for an interest. It is based in the United States and is heavily regulated, meaning that there are various KYC steps that one has to pass through. As annoying as this may be it guarantees that the platform is legit and trustworthy.

Pros

- Crypto loans

- 6% compound interest

- Automated trades

Cons

- Not available in some countries

What is a Bitcoin Exchange?

A Bitcoin exchange is an online platform that acts as an intermediary between buyers and sellers of digital assets. It is a digital marketplace that facilitates the buying and selling of Bitcoin using fiat currencies or other cryptocurrencies.

How do Bitcoin Exchanges Work?

A Bitcoin exchange is an online marketplace where investors can easily buy and sell Bitcoins. Bitcoin exchanges are similar to online brokerages in terms of payment methods. Traders can deposit money through various supported payment methods such as bank transfer, wire transfer and e-payment solutions like PayPal and Skrill. When using a Bitcoin exchange, the platform automatically matches buyers with sellers.

Traders can choose to buy or sell Bitcoin by placing a market order or limit order. A trader’s market order authorizes the exchange to trade their assets for the best available price. A limit order instructs the exchange to trade the crypto asset below the current asking or bidding price, depending on the type of trade.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Types of Bitcoin Exchanges

There are three different types of Bitcoin exchanges available for crypto investors to use:

● Centralized Exchanges:

A centralized exchange is also known as CEX and is a platform that is governed by a group of centralized organizations which offer cryptocurrency trades from fiat-to-cryptocurrency or crypto-to-crypto tender.

● Decentralized Exchanges:

A decentralized exchange, also referred to as DEX, is an alternative to a traditional centralized exchange. This type of platform does not depend on a company or any governing body to control the activities performed on the platform. The trades or financial activities are controlled by an automated process and considered peer-to-peer. Blockchain technology helps the decentralized exchanges to provide a secure way of transferring cryptocurrencies without any authority.

● Hybrids:

A hybrid exchange is a combination of centralized and decentralized exchanges. A hybrid exchange offers the decentralized nature of DEXs combined with the fast transaction speed of CEXs. Hybrids also use smart contracts like decentralized exchanges to ensure no centralized figure imposes on the integrity of trades. This reduces the security risk and protects customer assets.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

How to Choose the Best Bitcoin Exchanges for You

When choosing a Bitcoin exchange, there are certain factors a trader must consider before making trades and investments on any platform. Some of these factors are:

1. Security/regulations

Top-tier financial bodies adequately regulate the bitcoin exchanges. These regulatory bodies ensure the safety of customer information and assets. When choosing a crypto exchange, it is important to find out the security measures employed on the platform and what level of regulations the platform follows.

2. Fees

Fees are an important aspect of investing. A crypto exchange that charges exorbitant fees reduces the possibility of making substantial profits from successful trades. The best Bitcoin exchanges are those that provide high-end services at low rates.

3. Payment methods

Crypto trading is a financial opportunity that is available globally. Due to its widespread use cases, essential elements of a crypto exchange must include a wide range of payment methods. Several supported payment methods on an exchange enable users from around the globe to have equal access to its services.

4. User experience

Top rated bitcoin exchanges have a user-friendly interface that helps new traders easily get acclimatised with the concept of cryptocurrencies and the best ways to derive profits from them. A new trader must choose user-friendly and easy-to-navigate platforms.

5. Mobile app

Bitcoin exchanges with mobile apps are among the best options to pick from. The mobile app usually has all of the services available at the click of a button, making it easy for users to access payments, trades, and other services easily.

6. Customer service

From time to time, users run into problems processing payments and accessing portfolios which can be stressful. It is important that when choosing a cryptocurrency exchange, new traders opt for the one with 24/7 customer service. A good and responsive customer service allows traders to be at ease when they experience minor glitches and inconsistencies on the platform.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

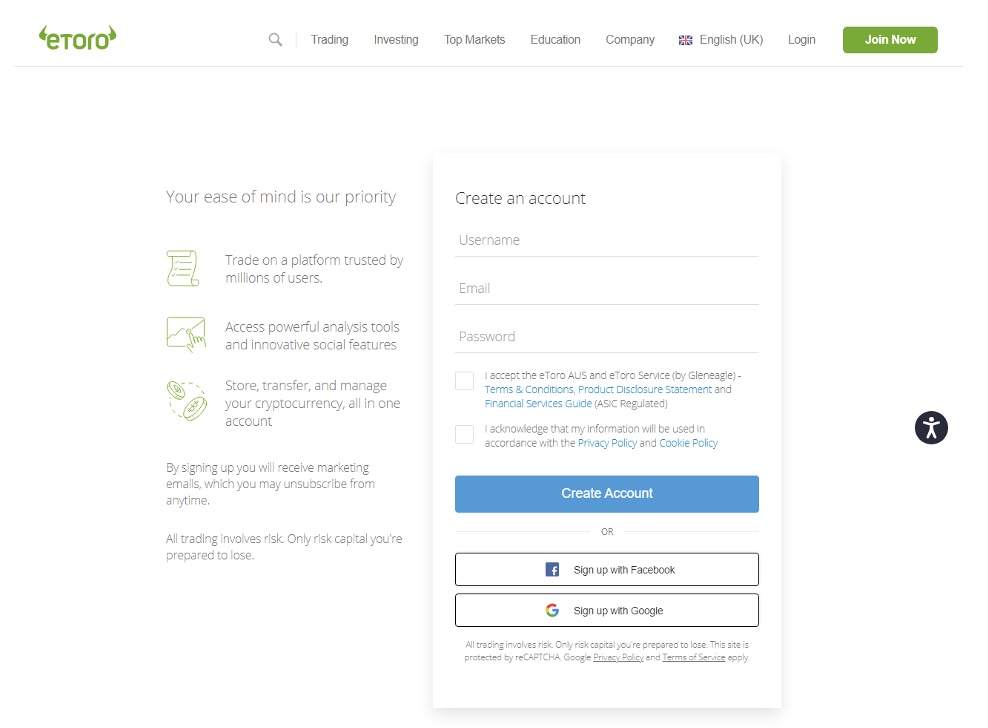

How to Get Started with the Best Bitcoin Exchanges – eToro Tutorial

To get started using the best bitcoin exchanges USA, follow the steps below to use our recommended platform eToro.

1. Open an account with eToro

Navigate to the eToro website and click on ‘Join Now’ to access the registration page. New users will be required to provide their full name, email address, mobile number, username and a unique password. Input the details and click on ‘CReate account’ to move forward. An alternative to this cumbersome process is to simply connect a Google or Facebook account to create a free account.

2. Verify ID

Complete the registration process by providing know-your-customer (KYC) information. All you need to do is upload a snapshot of a driver’s license or government-issued ID card. A copy of a recent utility bill or bank statement is also required.

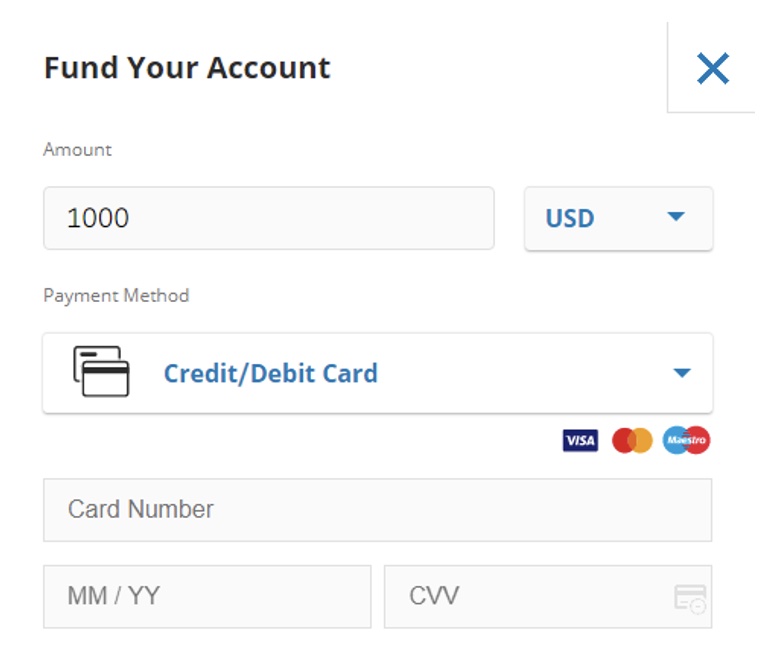

3. Deposit

Click on the ‘Deposit Funds’ button, and you will be redirected to the deposit page. Fund your account with a minimum first deposit of $10, $50 etc., through bank wire transfer, credit/debit card and e-wallet solutions. Type in how much you want to deposit and click on ‘Deposit’ to fund your account.

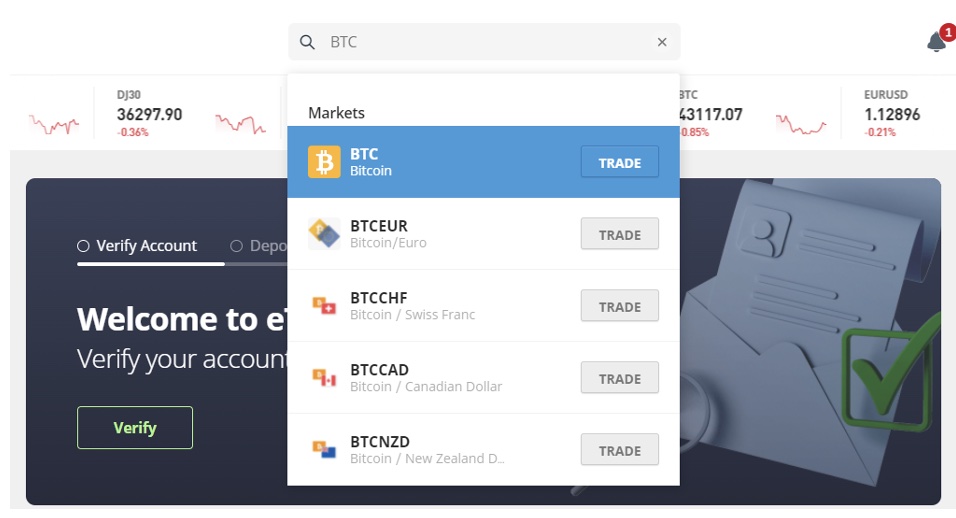

4. Search for Bitcoin

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Type ‘BTC’ into the search bar and click on the relevant popup result to be taken to the asset page. You can browse through the ‘Feed’ section to know more about how investors feel about the asset. You can chat up investors or click on the ‘Research’ button.

5. Buy

Click on ‘Trade’ to open the purchase page. Insert how much Bitcoin you want to buy and click on ‘Open Trade’ to complete the transaction.

Conclusion

Investing in cryptocurrencies has become one of the most lucrative means of growing your portfolio. Investors need a good crypto platform to help manage their investment portfolios and provide them with trading tools to make successful trades.

After considering the important factors when choosing a crypto exchange platform, we recommend eToro as the best exchange to buy Bitcoin.

eToro offers users state-of-the-art trading tools to make good gains when trading. The platform also offers standard trading pairs at affordable fee rates.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection. Your capital is at risk. Additionally, 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FAQs

How Do Bitcoin Exchanges Work?

Bitcoin exchanges are like brokerages that enable users to buy and sell cryptocurrencies. The platforms also allow users to trade crypto pairs with special trading tools.

How Do I Open a Cryptocurrency Exchange Account?

You can follow the easy step-by-step tutorial to open an account on the eToro platform.

What Is a Bitcoin Exchange Account?

A Bitcoin exchange account can be likened to a user’s unique portfolio, documenting their trades and transactions. The account also consists of a wallet where all assets are stored and distributed to.

Which Bitcoin Exchange Has the Lowest Fees?

eToro has the lowest fees for trades, deposits and withdrawals.

What Is the Safest Bitcoin Exchange?

eToro is the safest Bitcoin exchange as the platform is regulated by several top-tier regulatory bodies in the US and the UK.

What Is the Best Crypto Exchange for Us Customers?

The best crypto exchange for US customers is the CEX platform. The platform is duly regulated in 33 US states and provides higher limits for US customers.

How Do Crypto Exchanges Make Money?

Crypto exchanges make money through the fees and commissions charged to traders.

Why Do Bitcoin Exchanges Have Different Prices?

The prices depend on the platform’s volume and the supply and demand for the digital asset.

Advertising disclosure: We may receive compensation for some of the links in our stories. Thank you for supporting LA Weekly and our advertisers.